As you know, pension contributes a lot to a person’s life. Many types of pension schemes are run by the state government and the central government. Many types of pension scheme are available for the person from small to big. The various Sevana Pension schemes run by the Government of Kerala are called Sevana Pension . To avail the pension scheme, you have to apply for it. The benefit of the pension scheme is maximum to those people who are poor, whose economic condition is poor. The government has introduced several types of pension schemes for each category such as widow pension scheme for widow women, old age pension scheme, handicapped pension scheme etc.

What is Sevana Pension 2024 ?

The social welfare department and labor department of Kerala, the pension schemes run by various sections of the society are called Sevana Pension Scheme. Pension schemes are being run for different sections of the society such as farmers, widow women, disabled persons, old people etc. You can apply both online and offline in these pension schemes. If you apply online, you will not have to go to any government office, but you can apply with the help of your mobile phone.

There are many people in the society whose economic condition is very bad, who are in dire need of money, Kerala pension scheme is no less than a boon for such people. The beneficiaries can use the funds received from these pension schemes to meet their daily living expenses. Under these pension schemes, the beneficiary is given a pension of up to Rs 1600 per month.

Type of Sevana Pension Scheme

This pension scheme mainly consists of 5 types of pension schemes, which are as follows:

- Agriculture Labour Pension

- Indira Gandhi National Old Age Pension

- Indira Gandhi National Disabled Pension Scheme – Mentally/Physically

- Pension to Unmarried Women above 50 years

- Indira Gandhi National Widow Pension Scheme

Agriculture Labour Pension

This pension scheme was earlier handled by the Labor Department but later it was transferred to the local bodies on the orders of the Central Government. To apply for this pension scheme, you have to submit the application form to the Gram Panchayat / Municipality / Corporation Secretary.

Agriculture Labor Pension is provided to the laborers working in the agricultural sector of the state. The beneficiary list is issued within 45 days of applying. If the applicant’s application form is accepted, then the beneficiary’s pension is started in the first week of the next month.

Eligibility for Agriculture Labor Pension Scheme:

- The application must be a permanent resident of Kerala.

- Applicant’s age should be 60 years or more.

- The annual income of the family of the applying person should not exceed Rs. 1 lakh.

- The candidate should not be a pensioner / family pensioner.

- The applicant should not be an income tax payer.

- The person applying should be residing in Kerala for at least 10 years.

- Candidates have worked as agricultural laborers for 10 years or more under the landowners.

- The applicant should not own more than 2 acres except for the Scheduled Tribes.

- Candidate should be a member of Kerala Agricultural Workers Welfare Fund.

- The applicant should not have non-taxi, four or more wheel vehicles with engine capacity of more than 1000 cc.

- Plantation workers cannot apply under this scheme.

- If the application is taking benefit of other salary / pension / family pension of Central Government or State Government, then they cannot apply in this scheme.

- The person applying should be destitute.

- Retired persons from Central / State Public Sector Undertakings are not eligible for this scheme.

- The beneficiary of social welfare pension scheme other than disabled pension cannot apply in this scheme.

- Applicants should not be from two different local bodies.

History of pension amount for agricultural labor pension:

| Pension Type | Date | Amount |

|---|---|---|

| Agriculture Labour Pension | 01/04/2000 | 120 |

| Agriculture Labour Pension | 01/04/2007 | 130 |

| Agriculture Labour Pension | 01/04/2008 | 200 |

| Agriculture Labour Pension | 01/04/2009 | 250 |

| Agriculture Labour Pension | 01/04/2010 | 300 |

| Agriculture Labour Pension | 01/04/2011 | 400 |

| Agriculture Labour Pension | 01/04/2013 | 500 |

| Agriculture Labour Pension | 01/04/2014 | 600 |

| Agriculture Labour Pension | 01/06/2016 | 1000 |

| Agriculture Labour Pension | 01/04/2017 | 1100 |

| Agriculture Labour Pension | 01/04/2019 | 1200 |

| Agriculture Labour Pension | 01/04/2020 | 1300 |

| Agriculture Labour Pension | 01/09/2020 | 1400 |

| Agriculture Labour Pension | 01/01/2021 | 1500 |

| Agriculture Labour Pension | 01/04/2021 | 1600 |

Indira Gandhi National Old Age Pension

Earlier this scheme was controlled by the revenue department of the state government but now it has been transferred to local self-government institutions. To take advantage of this scheme, according to the 8th pension rule, approval of the Collector is mandatory. The person whose elder son does not take care of parents is also eligible for pension.

Under Indira Gandhi National Old Age Pension Scheme, you have to submit the application to the concerned Gram Panchayat / Municipality / Corporation Secretary. After accepting the application of the applicant, his pension is started in the first week of the next month.

Eligibility for Indira Gandhi National Old Age Pension Scheme:

- Application should be helpless.

- The annual income of the family of the applying person should not exceed Rs. 1 lakh.

- The service pensioner / family pensioner beneficiary is not eligible for this scheme.

- The candidate should not be under the patronage of anyone else.

- The person should not be an income tax payer.

- Except for disabled pension, if the applicant is taking benefit of other social welfare pension, then he cannot apply in it.

- The candidate should not be owned by more than two acres.

- The applicant should not have non-taxi, four or more wheel vehicles with engine capacity of more than 1000 cc.

- If the applicant is taking benefit of the salary pension, family pension of the Central Government or the State Government, then it cannot apply in it.

- People 60 years or older are eligible for this scheme.

- Persons retired from Central/State Public Sector Undertakings are not eligible.

- Have been living in Kerala for at least three years.

- Applicants from two different bodies are not eligible.

History of pension amount for Indira Gandhi National Old Age Pension Scheme:

| Pension Type | Date | Amount | Age 75 Years or Disability % 80 above Amount |

|---|---|---|---|

| Indira Gandhi National Old Age Pension Scheme | 01/08/1996 | 110 | 110 |

| Indira Gandhi National Old Age Pension Scheme | 01/04/2006 | 235 | 235 |

| Indira Gandhi National Old Age Pension Scheme | 01/04/2008 | 250 | 250 |

| Indira Gandhi National Old Age Pension Scheme | 01/04/2010 | 300 | 300 |

| Indira Gandhi National Old Age Pension Scheme | 01/04/2011 | 400 | 400 |

| Indira Gandhi National Old Age Pension Scheme | 01/04/2012 | 400 | 900 |

| Indira Gandhi National Old Age Pension Scheme | 01/04/2013 | 500 | 1100 |

| Indira Gandhi National Old Age Pension Scheme | 01/04/2014 | 600 | 1200 |

| Indira Gandhi National Old Age Pension Scheme | 01/04/2016 | 600 | 1500 |

| Indira Gandhi National Old Age Pension Scheme | 01/06/2016 | 1000 | 1500 |

| Indira Gandhi National Old Age Pension Scheme | 01/04/2017 | 1100 | 1500 |

| Indira Gandhi National Old Age Pension Scheme | 01/04/2019 | 1200 | 1500 |

| Indira Gandhi National Old Age Pension Scheme | 01/04/2020 | 1300 | 1500 |

| Indira Gandhi National Old Age Pension Scheme | 01/09/2020 | 1400 | 1500 |

| Indira Gandhi National Old Age Pension Scheme | 01/04/2021 | 1600 | 1600 |

| Indira Gandhi National Old Age Pension Scheme | 01/01/2021 | 1500 | 1500 |

Indira Gandhi National Disabled Pension Scheme – Mentally/Physically

The benefits of this scheme are given to mentally and physically handicapped persons. Earlier this scheme was controlled by the revenue department of the state government but now it has been transferred to local self-government institutions. Persons with more than 40% disability are eligible for this scheme.

To apply in this scheme, you have to submit the application form to the concerned Gram Panchayat / Municipality / Corporation Secretary. After accepting the beneficiary’s application, money is started to be sent to the beneficiary’s bank account.

Eligibility for Indira Gandhi National Disabled Pension Scheme:

- There is no age limit in this scheme.

- The annual income of the applicant’s family should be less than Rs 1 lakh.

- Candidate must be destitute.

- The person applying should not be an income tax payer.

- If the applicant is a service pensioner / family pensioner, then he cannot apply in this scheme.

- The applicant should not own more than two acres except the Scheduled Tribes.

- The applicant should not have non-taxi, four or more wheel vehicles with engine capacity of more than 1000 cc.

- If the applicant is taking benefit of salary / pension / family pension of Central Government or State Government, then he will not be eligible for this scheme.

- Candidates will have to submit medical certificate / identity card of disability issued by the Social Security Mission.

- Retired person from Central or State Public Sector Undertakings will not be eligible.

- Applicants from two different local bodies will not be eligible.

History of pension amount for Indira Gandhi National Disability Pension Scheme:

| Pension Type | Date | Amount | Age 75 Years or Disability % 80 above Amount |

|---|---|---|---|

| Indira Gandhi National Disability Pension Scheme | 01/04/2000 | 110 | 110 |

| Indira Gandhi National Disability Pension Scheme | 01/08/2005 | 140 | 140 |

| Indira Gandhi National Disability Pension Scheme | 01/04/2007 | 160 | 160 |

| Indira Gandhi National Disability Pension Scheme | 01/04/2008 | 200 | 200 |

| Indira Gandhi National Disability Pension Scheme | 01/04/2009 | 250 | 250 |

| Indira Gandhi National Disability Pension Scheme | 01/04/2010 | 300 | 300 |

| Indira Gandhi National Disability Pension Scheme | 01/04/2011 | 400 | 400 |

| Indira Gandhi National Disability Pension Scheme | 01/04/2012 | 525 | 700 |

| Indira Gandhi National Disability Pension Scheme | 01/04/2013 | 700 | 1000 |

| Indira Gandhi National Disability Pension Scheme | 01/04/2014 | 800 | 1100 |

| Indira Gandhi National Disability Pension Scheme | 01/06/2016 | 1000 | 1100 |

| Indira Gandhi National Disability Pension Scheme | 01/04/2017 | 1100 | 1100 |

| Indira Gandhi National Disability Pension Scheme | 21/02/2018 | 1100 | 1300 |

| Indira Gandhi National Disability Pension Scheme | 01/04/2019 | 1200 | 1300 |

| Indira Gandhi National Disability Pension Scheme | 01/04/2020 | 1300 | 1300 |

| Indira Gandhi National Disability Pension Scheme | 01/09/2020 | 1400 | 1400 |

| Indira Gandhi National Disability Pension Scheme | 01/04/2021 | 1600 | 1600 |

| Indira Gandhi National Disability Pension Scheme | 01/01/2021 | 1500 | 1500 |

Pension to Unmarried Women above 50 years

This is a new pension scheme which has been started on the orders of the state government. Presently the scheme has been entrusted to the local bodies. The benefit of this scheme is given to unmarried women above 50 years. At the time of applying, it will be mandatory to give the age certificate to the applicant.

Applicant can submit the application form to the concerned Gram Panchayat / Municipality / Corporation Secretary. After accepting the application of the applicant, he will start sending the pension amount from the first week of the next month.

Eligibility for Pension to Unmarried Women above 50 years:

- The age of the applicant should be 50 years or more.

- The annual income of the family of the applying person should be less than 1 lakh rupees.

- The person applying should not be an income tax payer.

- Only unmarried person is eligible for this scheme.

- Service pensioner / family pensioner cannot apply.

- You will not be eligible if you are taking benefit of any other social pension scheme except disability pension.

- Applicant should not own more than two acres.

- Candidates should not have non-taxi, four or more wheeled vehicles with engine capacity of more than 1000 cc.

- If the person applying is receiving salary / pension / family pension from the Central Government or the State Government, then he will not be eligible.

- Applicant must be a permanent resident of the state of Kerala.

- Unmarried mothers whose age is 50 years or more can apply.

History of pension amount for unmarried women above 50 years:

| Pension Type | Date | Amount |

|---|---|---|

| Pension for the Unmarried Women above 50 years | 01/04/2001 | 110 |

| Pension for the Unmarried Women above 50 years | 01/04/2007 | 120 |

| Pension for the Unmarried Women above 50 years | 01/04/2008 | 200 |

| Pension for the Unmarried Women above 50 years | 01/04/2009 | 250 |

| Pension for the Unmarried Women above 50 years | 01/04/2010 | 300 |

| Pension for the Unmarried Women above 50 years | 01/04/2011 | 400 |

| Pension for the Unmarried Women above 50 years | 01/04/2012 | 525 |

| Pension for the Unmarried Women above 50 years | 01/04/2013 | 700 |

| Pension for the Unmarried Women above 50 years | 01/04/2014 | 800 |

| Pension for the Unmarried Women above 50 years | 01/06/2016 | 1000 |

| Pension for the Unmarried Women above 50 years | 01/04/2017 | 1100 |

| Pension for the Unmarried Women above 50 years | 01/04/2019 | 1200 |

| Pension for the Unmarried Women above 50 years | 01/04/2020 | 1300 |

| Pension for the Unmarried Women above 50 years | 01/09/2020 | 1400 |

| Pension for the Unmarried Women above 50 years | 01/04/2021 | 1600 |

| Pension for the Unmarried Women above 50 years | 01/01/2021 | 1500 |

Indira Gandhi National Widow Pension Scheme

The widow pension scheme operated by the social welfare department of the state government has been transferred to local self-government institutions. Destitute widow women are given the benefit of this scheme. You can apply for this scheme with the concerned Gram Panchayat / Municipality / Corporation Secretary. After accepting the application, your pension will be started.

Eligibility for Indira Gandhi National Widow Pension Scheme:

- Applicant must be destitute.

- There is no age limit to apply in the scheme.

- Applicant must be a permanent resident of the state of Kerala.

- The annual income of the family of the applying person should not exceed Rs. 1 lakh.

- Widow women are eligible for this scheme.

- The applicant should not be an income tax payer.

- The beneficiary of the pension scheme other than the disabled pension cannot apply.

- The beneficiary should not have more than two acres of ownership.

- The applicant should not have any type of two wheeler or four wheeler.

- The recipient of salary / pension / family pension from the State Government or Central Government cannot apply.

History of pension amount for Indira Gandhi National Widow Pension Scheme:

| Pension Type | Date | Amount |

|---|---|---|

| Indira Gandhi National Widow Pension Scheme | 01/11/1995 | 100 |

| Indira Gandhi National Widow Pension Scheme | 01/08/1996 | 110 |

| Indira Gandhi National Widow Pension Scheme | 01/04/2007 | 120 |

| Indira Gandhi National Widow Pension Scheme | 01/04/2008 | 200 |

| Indira Gandhi National Widow Pension Scheme | 01/04/2009 | 250 |

| Indira Gandhi National Widow Pension Scheme | 01/04/2010 | 300 |

| Indira Gandhi National Widow Pension Scheme | 01/04/2011 | 400 |

| Indira Gandhi National Widow Pension Scheme | 01/04/2012 | 525 |

| Indira Gandhi National Widow Pension Scheme | 01/04/2013 | 700 |

| Indira Gandhi National Widow Pension Scheme | 01/04/2014 | 800 |

| Indira Gandhi National Widow Pension Scheme | 01/06/2016 | 1000 |

| Indira Gandhi National Widow Pension Scheme | 01/04/2017 | 1100 |

| Indira Gandhi National Widow Pension Scheme | 01/04/2019 | 1200 |

| Indira Gandhi National Widow Pension Scheme | 01/04/2020 | 1300 |

| Indira Gandhi National Widow Pension Scheme | 01/09/2020 | 1400 |

| Indira Gandhi National Widow Pension Scheme | 01/04/2021 | 1600 |

| Indira Gandhi National Widow Pension Scheme | 01/01/2021 | 1500 |

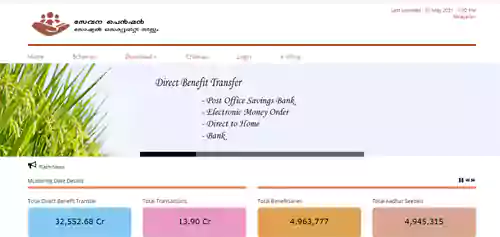

Sevana Pension 2024 Registration Process

If you too are eligible for this scheme and you want to apply in this scheme, then follow the steps given below:

Step 1: First of all you have to come to the official website of kerala pension portal.

Step 2: On the home page of the website, the option of application form will appear in the option of download, click on it.

Step 3: On the next page, application forms of pension schemes will appear in front of you in this way:

- Agriculture Labour Pension

- Indira Gandhi National Old Age Pension

- Indira Gandhi National Disabled Pension for Mentally/Physically challenged

- Pension for unmarried women above 50 years

- Indira Gandhi National Widow Pension Scheme

Step 4: Download the form of the pension scheme for which you want to apply.

Step 5: Enter all the information sought in the form correctly, attach your documents and submit it to the concerned Gram Panchayat / Municipality / Corporation Secretary.

Step 6: In this way, you will be applied for pension scheme.

Login process on portal

- First of all, come to its official website.

- Login option will appear on the home page, click on it.

- The login form will open on the next page.

- You can login by entering username, password and captcha code in it.

pension search Procedure

Step 1: First of all, you have to come to the official website of kerala pension portal.

Step 2: The option of Pensioner Search will appear on the home page of the website, click on it.

Step 3: On the next page you will see three options:

- Pensioner ID

- Aadhar No

- Account No

Step 4: You can select any one option as per your convenience.

Step 5: After that enter the number and click on search. After clicking, the related information will come to you.

Procedure to see eligibility for Sevana Pension scheme

- First of all, visit the official website of this portal, welfarepension.lsgkerala.gov.in.

- Criterias option will appear on the home page, click on it.

- On the next page, the eligibility along with the pension scheme will appear in front of you.

E-filing process

- First of all, you have to come to the official website of kerala pension portal.

- E-filing option will appear on the home page of the website, click on it.

- The login form will open in front of you on the next page.

- Login with the help of username and password.

- After login, you can do the E-filing process.

Procedure for downloading sevana pension dbt documents

Step 1: First of all, you have to come to the official website of kerala pension portal.

Step 2: On the home page, the option of dbt documents will appear in the option of download, click on it.

Step 3: The list of documents will open on the next page.

Step 4: Click on the option to click here in front of the document you want to download.

Step 5: After clicking, the document will open in PDF format, which you can download.

Social Security Pension Government Orders Viewing Procedure

- For this, first come to the official website.

- On the home page, the option of Government Orders will appear in the option of download, click on it.

- On the next page, a list of New Government Orders will come in front of you.

Pension Dashboard Viewing Process

- First of all, come to the official website.

- The option of pension dashboard will appear on the home page, click on it.

- After clicking, the pension dashboard will open in front of you on the next page, where you will get all the information related to the pension.

State Wise Social Security Sevana Pension Details

- Come to the official website.

- The option of the report will appear on the home page, click on it.

- After clicking on the new page, State Wise Social Security Pension Details will open in front of you.

Sevana pension helpline number

- Helpline Number – 0471-2327526, 180042511800

- Email Id– dbtcell2017@gmail.com

- uidhelpdesk@kerala.gov.in